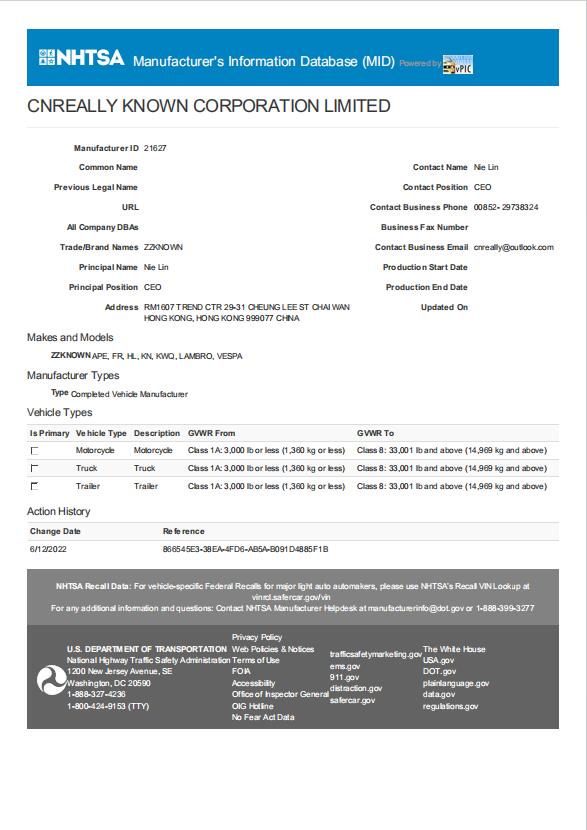

Importing a trailer—whether it's a food trailer, utility trailer, or mobile vending unit—into the United States can seem daunting. Between the customs process, safety regulations, and licensing hurdles, there’s a lot to navigate. But with the right steps and clear guidance, it's very doable. This article breaks it all down: from choosing the right trailer overseas to getting it legally licensed and road-ready in the U.S.

Before importing, you need to confirm that your trailer complies with DOT (Department of Transportation) and EPA (Environmental Protection Agency) standards. These include:

Safety lighting and reflectors

Axle and brake system specifications

Emissions standards (if motorized)

Some trailers, especially from overseas manufacturers, may not be pre-certified for U.S. use. In that case, you'll need to hire a Registered Importer (RI) or Independent Commercial Importer (ICI) to modify it.

Importing a trailer isn't just shipping—it involves navigating U.S. Customs and Border Protection (CBP) regulations. A customs broker can help manage:

Entry Summary (CBP Form 7501)

Bill of Lading

Commercial Invoice

Packing List

EPA Form 3520-1 (for motorized units)

Working with a broker not only reduces errors but speeds up the release process at port.

“A good customs broker is like having a translator for federal law—they speak the language so you don’t have to.” – U.S. Import Specialist, J. Rivera

When importing a trailer, you'll typically pay:

2.5% Import Duty (for most trailers)

Merchandise Processing Fee

Harbor Maintenance Fee

Costs may vary depending on trailer type and country of origin. Use the Harmonized Tariff Schedule (HTS Code 8716) for trailers to get an exact figure.

Once the trailer clears customs, you’ll need to get a Vehicle Identification Number (VIN) and register it with your State DMV.

Some imported trailers don’t come with a U.S.-compliant VIN, so your local DMV may assign you a State-Issued VIN Plate after inspection.

Documents typically required include:

Import documentation (CBP release forms)

Proof of ownership

Inspection certificate (if applicable)

This is where things get specific. Depending on your trailer’s use (food service, vending, hauling), you may need:

Business License

Mobile Vendor Permit

Health Department Certificate

Fire Department Clearance

Each city or county may have different rules. For example, a food trailer in Los Angeles requires additional fire suppression system certification, while in Texas, a commissary agreement is mandatory.

Food Trailer: Health permit, fire inspection, food manager certification

Utility Trailer: Weight certification, registration, commercial license (if applicable)

Mobile Shop: Local business license, zoning clearance

Trailer insurance is often overlooked but crucial. Policies vary depending on trailer type and use:

Commercial Auto Insurance (for towing)

General Liability Insurance

Property Insurance (for contents and equipment)

Work with an agent familiar with trailers and mobile businesses. Some insurers specialize in food trucks and mobile units.

Collision and comprehensive

Equipment and inventory

Worker’s comp (if you employ staff)

✅ Check DOT/EPA compliance before buying overseas

✅ Use a licensed customs broker

✅ Budget for duties and taxes (2.5%+ fees)

✅ Secure a state-issued VIN if needed

✅ Research local license and health rules early

✅ Insure the trailer before operating

Bringing a trailer into the U.S. for business or personal use isn’t just a matter of shipping—it involves compliance, documentation, and licensing at multiple levels. But by following a clear step-by-step process and seeking help from brokers, inspectors, and local authorities, you can legally and safely import your trailer and get it on the road. Whether you're launching a food business or importing a custom trailer from overseas, the groundwork you lay now ensures smooth operations later.